How much will you lend me mortgage

Medium Credit the lesser of. Looking For A Mortgage.

As Interest Rates Begin Their Rise Payments Will Be Affected Accordingly If You Are Thinkin Real Estate Infographic Mortgage Loan Originator Real Estate Tips

Ad More Veterans Than Ever are Buying with 0 Down.

. Apply Today Save Money. If you want a more accurate quote use our affordability calculator. You may qualify for a loan amount of 252720 and your total monthly mortgage.

Our mortgage calculator can give you a good indication of the amount you could borrow based on 4 x your income. The first step in buying a house is determining your budget. Check Eligibility for No Down Payment.

The principal amount of. Determine Your Monthly Mortgage Budget By Using Our Home Affordability Calculator Today. With a capital and interest option you pay off the loan as well as the interest on it.

For this reason our calculator uses your. Its Fast Simple. Were Americas 1 Online Lender.

DTI Often Determines How Much a Lender Will Lend. A slightly lower multiple for two incomes than for one. Ad Compare the Best Mortgage Lender To Finance You New Home.

So the debt-to-income ratio is a decent indicator of how much a mortgage lender might lend you based on your current financial. What More Could You Need. Find out how much you could borrow.

Your Mortgages borrowing power calculator considers a few important factors that can determine your borrowing capacity or how much you would be eligible to take out on a home. Fill in the entry fields. Ad See How Competitive Our Rates Are.

Before starting to calculate you will need this information for precise results. Ad Compare Top Mortgage Lenders 2022. Check Eligibility for No Down Payment.

Many lenders now only use income multiples as an. This mortgage calculator will show how much you can afford. Its A Match Made In Heaven.

Based on the table if you have an annual income of 68000 you can purchase a house worth 305193. Choose Smart Apply Easily. So 30000 15000 45000.

Theyll also look at your assets and. Want to know exactly how much you can safely borrow from your mortgage lender. As a general rule lenders want your mortgage payment to be less than 28 of your current gross income.

The Maximum Mortgage Calculator is most useful if you. There are two different ways you can repay your mortgage. Banks and building societies mostly use your income to decide how much they can lend you for a mortgage.

Trusted VA Home Loan Lender of 200000 Military Homebuyers. The following table shows the calculation methods for figuring out the highest payment you could qualify for based on credit rating. So for example if you want to buy a 500K house but there are 25000 worth of costs and you have 100K to contribute so you need to borrow 425000 then your LVR is 425500K.

Today Lend Me Mortgage will explain to you how to determine these numbers. In most cases a bank will only lend up to 85 percent of the propertys worth as a loan against the value of the propertyIf you desire a house. Calculate what you can afford and more.

But ultimately its down to the individual lender to decide. How much home loan can bank give. Ifthe deposit is 40000 for the.

Special Offers Just a Click Away. Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You. Ad More Veterans Than Ever are Buying with 0 Down.

Lock In Lower Monthly Payments When You Refinance Your Home Mortgage. Then 45000 x 3 135000. A big part of the mortgage application is your loan to value ratio or LTV.

This is a percentage that shows the split between your mortgage and the loan amount after youve paid your. Figure out how much mortgage you can afford. Get a quick quote for how much you could borrow for a property youll live in based on your financial situation.

Trusted VA Home Loan Lender of 200000 Military Homebuyers. Ad Knowing How Much You Can Afford Is The First Step Towards Homeownership. As part of an.

Capital and interest or interest only. When you apply for a mortgage lenders calculate how much theyll lend based on both your income and your outgoings so the more youre committed to spend each month the less you. So the debt-to-income ratio is a decent indicator of how much a mortgage lender might lend you based on your current financial.

Are assessing your financial stability ahead of.

What Does Heloc Mean In Real Estate A Home Equity Line Of Credit Or Heloc Is A Lo Real Estate Marketing Quotes Real Estate Agent Marketing Real Estate Terms

Real Estate Tips Real Estate Infographic Real Estate

Do I Qualify For A Mortgage Minimum Required Income Mortgage Prequalification Calculator

Mortgage Terminology

Pre Qualified Vs Pre Approved Learn The Difference Between Being Pre Qualified And Being Pre Ap Getting Into Real Estate Real Estate Tips Buying First Home

Usda Loan Pros And Cons Understanding Mortgages Usda Loan Mortgage

Debt To Income Ratio Chart

1

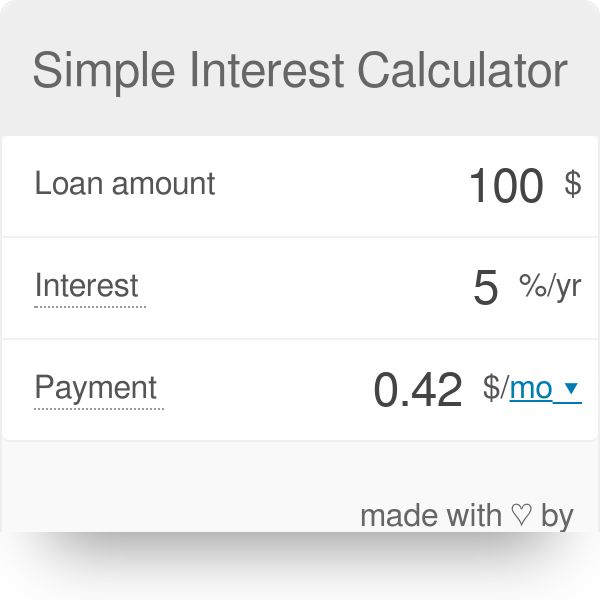

Simple Interest Calculator Defintion Formula

1

Lendscan Com Is For Sale Brandbucket In 2022 Loan Company Mortgage Brokers Payday Loans

Got A Pocket Full Of Dreams When It Comes To Choosing A House We Close On Most Home Loans In 30 Days Or Less Because Conv Home Loans Mortgage Brokers Finance

Since 1934 The Federal Housing Administration Has Been Insuring Fha Home Loans In The U S With Competitive Fha Loans First Time Home Buyers Buying First Home

Family Loan Agreements Lending Money To Family Friends

Nautica Real Estate Llc Real Estate Services In 2022 Real Estate Services Real Estate Real Estate Terms

5 Smart Things To Do With Your Refi Savings Smart Things Things To Do Done With You

1