Ira projection calculator

This is a projection into the future. The Methodology Assumptions and Limitations of the Personal Retirement Calculator.

What Is The Best Roth Ira Calculator District Capital Management

Course materials exam information and professional learning opportunities for AP teachers and coordinators.

. Use our compound interest calculator to see how your savings or investments might grow over time using the power of compound interest. The funds converted to your Roth IRA whether they come from the 401k or your IRA will generally be taxable. Continuing to allow it to grow tax-deferred such as in a.

Enter the amount of your new grant - whether an offer grant or an annual refresh. This calculator is designed to help you create the most effective funding strategy to cover your expected college costs using a 529 plan. This calculator will help you compare the effects of taxes and penalties on the taxable portion of a full distribution vs.

If youre looking to open a reliable no fees for life IRA account invest in precious metals today. Now we need to set some assumptions about how they will grow in the future. College cost projections are made with the assumption that the cost of college will increase at the rate of inflation indicated in the education cost.

The House of Representatives is considering the Inflation Reduction Act of 2022 the Senate substitute amendment that replaced all provisions of a bill previously passed by the House in November 2021 Inflation Reduction Act of 2022 HR5376 Engrossed Amendment Senate. This may mean lowering your lifestyle expenditure. Retirement Calculator Tips For Best Results.

And well tell you how long you could make it last. Schwab Intelligent Income Projection Your monthly withdrawal goal of 2330 is on target to last through age 95. All values you entered were in current prices.

Taxes are unavoidable and without planning the annual tax liability can be very uncertain. Then from there you can convert any amount you wish to your Roth IRA. The calculator creates a compound growth projection for your savings or investments over a period of years and months based upon an anticipated rate of interest.

Actual outcomes may vary. 529 State Tax Calculator Learning Quest 529 Plan. This is an easy way to accomplish both a tax-free rollover of some funds and a Roth conversion for the rest.

Orange Money is the money you save for tomorrow. Using the RSU Projection Calculator. Retirement Savings Calculator Am I saving enough for my retirement.

Note that attendance costs and scholarship availability can vary considerably from school to school. The employer output for the SIMPLE IRA calculator above is. The Worlds Simplest College Cost Calculator allows you to estimate costs based on school types ie.

The information generated by the Personal Retirement Calculator was developed by Chief Investment Office CIO to estimate how current savings or investments and estimated future contributions may help to meet estimated financial needs in retirement. Both versions are reconciliation bills and both include provisions written by the. This calculator is meant to give you a general idea about where you stand financially based on the amounts provided.

If you are looking to find out if you will get a tax refund or if you owe money this year here is a simple Excel spreadsheet that can help you estimate federal and state income taxes before you file your return in 2021. Click here for a 2022 Federal Tax Refund Estimator. These estimates are not set in stone or intended as investment advice.

You can adjust your entries over time based on your actual experience. Use this calculator to create a projection of your future Required Minimum Distributions RMD as a Eligible Designated Beneficiary of a qualified retirement account or if the original account owner died before January 1 2020. Money Advice News And Product Reviews From A Name You Trust.

The formulas and spreadsheets shown and linked below take the new tax reform and tax cuts into account that went into effect under President Trump. RMD Stretch IRA Calculator. If you contributed 5000 to a traditional IRA in 2016 and received no deduction for that contribution your basis in those funds would be 5000.

Please note that MoneyBee does not provide investment advice. Spend It or Save It Calculator There are several ways to manage your retirement assets when you leave your company. A retirement calculator is a valuable tool when used properly but can dangerously mislead you when used improperly.

Use this calculator for a spouse beneficiary assumes spouse rolls to own IRA or. This is due to various factors including market performance and your individual investment decisions. This pre-retirement calculator was developed to help you determine how well you have prepared and what you can do to improve your retirement outlook.

It is important that you re-evaluate your preparedness on an ongoing basis. The best retirement calculators allow you to model your financial plan by varying input assumptions and then projecting those assumptions into the future. To use the RSU projection calculator walk through the following steps.

Use the following calculator to help determine your estimated tax liability along with your average and marginal tax rates. Smart Financial Decisions Made Simple. This option will balance your portfolio and safeguard you against future threats.

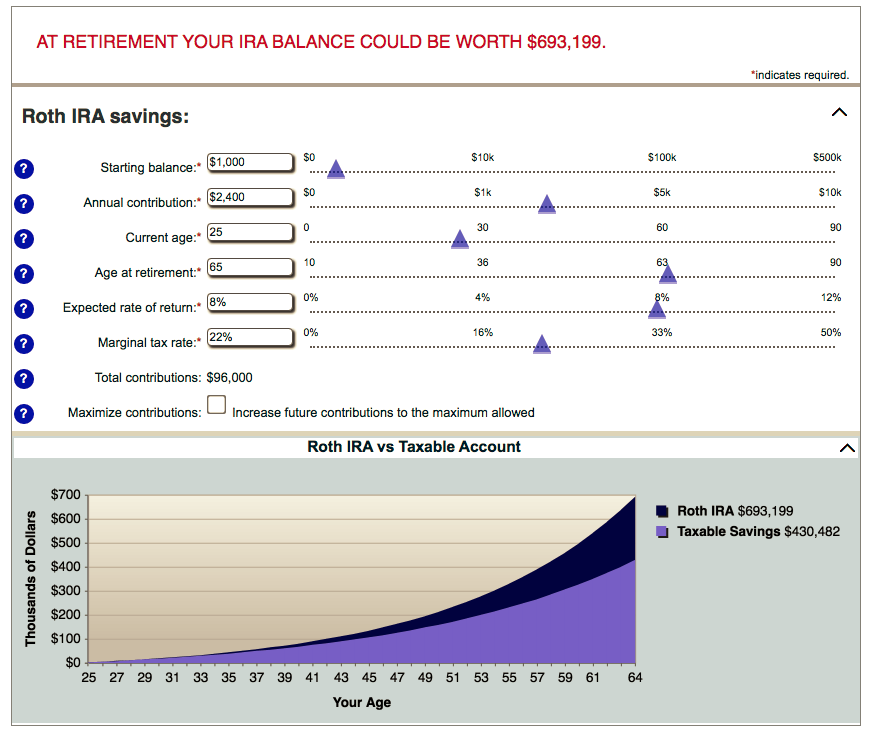

RMDs from enrolled Traditional IRA accounts. An IRA are assumed to grow by the stated investment rate of return selected on the slider until your stated retirement age is reached. Use this free debt calculator to determine the fastest and easiest way to pay down your debts.

Input your current marginal tax rate on vesting RSUs. If youre converting nondeductible IRA funds report as income the current value of the funds on the day you convert less your basis. Be sure to routinely review your financial situation and make adjustments accordingly.

Planning for retirement starts with a goal. Estimate how much your RSU value will increase per year. Retirement can be the happiest day of your life.

The last output that the SIMPLE IRA calculator above supplies is a projection of how much your SIMPLE IRA account will grow over five years. This projection is based on five years of the same annual contributions and the same employer matching along with an annual return of 5 percent. Decide on your strategy.

To get started on opening your no fees IRA account call the Patriot Gold Group at 877 711-6641 or fill out the form at the bottom of this page. Calculate the maximum amount you should offer so you dont over pay for a deal. 5000 of income minus zero for the deduction.

Determine potential profit analyze multiple exit strategies including Fix Flip Wholesale Buy--Hold Rental Value-Add BRRRR or House HackBuild your confidence learn. Federal Income Tax Calculator 2022 federal income tax calculator. Roth IRA or 401k is a super-efficient.

Overlooked amid last seasons mayhem is that for six weeks last fall the Eastern Conference was in full chase mode of the Brooklyn Nets who stood atop the standings from mid-November until the.

Download Traditional Vs Roth Ira Calculator In Excel Exceldatapro

Fidelity S Retirement Calculators Can Help You Plan Your Retirement Income Savings And Assess Your Financial Health Fidelity

What Is The Best Roth Ira Calculator District Capital Management

Download Traditional Vs Roth Ira Calculator In Excel Exceldatapro

Roth Ira Calculators

Download Roth Ira Calculator Excel Template Exceldatapro

Roth Ira Calculators

Roth Ira So Let S Say You Put Away The Maximum 5 500 Each Year And Continue To Put Away That Amount Adjusted For Inflation Wealth Building Roth Ira Wealth

Download Traditional Ira Calculator Excel Template Exceldatapro

Hp 10bii Financial Calculator Nw239aa By Hp 26 99 A Smart Choice For Professionals And Students Th Financial Calculator Calculator Financial Calculators

What Is The Best Roth Ira Calculator District Capital Management

Ira Calculator See What You Ll Have Saved Dqydj

How To Use A Roth Ira Calculator Ready To Roth

Taxable Vs Tax Deferred Investment Growth Calculator Investing Investment Advice Investing Money

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Business Woman Analysis And Calculate Tax Financial On Calculator Machine Account Accountant Accounting Png And Vector With Transparent Background For Free D Financial Accounting Business Women

Traditional Vs Roth Ira Calculator